Tax Rate Calculator

Tax Rate Calculator

Finding your home's value

Use our Tax Rate Simulator to calculate your savings!

In 2021, Kingsbridge MUD tax rates levied were lowered from $0.51 to $0.49 per $100 of total property value. This new rate of $0.49 is broken down into $0.25 for Maintenance and Operations and $0.24 for Debt Services.

Residents can calculate their MUD tax savings by multiplying 0.0049 ($0.049/$100) times their appraised home value. For residents with a home appraised at $200,000, they will yield a savings of approximately $40 on their annual property taxes thanks to these reduced tax rates in Kingsbridge MUD.

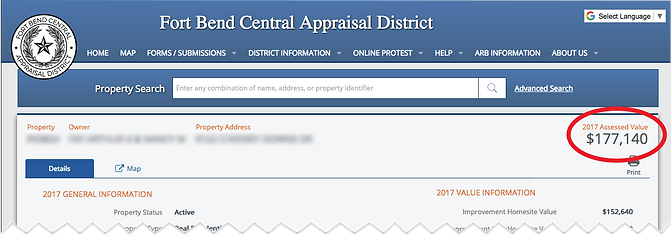

Residents can find their appraised home value by going to the Fort Bend Central Appraisal District's website http://www.fbcad.org/www.fbcad.org and typing in their address. This site shows all of the taxing entities for residents such as school districts, emergency service districts, etc.

Savings calculator

$0.00

$0.00

$0.00

District Taxing Entities Breakdown

Below is a list of taxing entities in addition to local, and state districts that you might fall under. For more information please send your question through the ContactContact Us page.